Insights from The Digital Euro Conference at the Central Bank of Luxembourg

By Ionela Tornea - Portfolio Management

Picture Source: Wikipedia https://commons.wikimedia.org/wiki/File:Luxembourg,_Banque_centrale_%282%29.jpg

The Digital Euro has moved from a theoretical idea to a concrete policy project at EU level. As the European Central Bank works through the preparation phase, Luxembourg’s financial community is already discussing what this new form of public money could mean for a market heavily reliant on international payment providers. Following this process, members of the Goldbridge Investment Club, together with our partners at INVESTAS, attended a dedicated conference, organised by Investas and BCL, at the Banque Centrale du Luxembourg (BCL) led by Nicolas Weber, Executive Director at BCL.

A Look Inside the Conference

The event brought together a mix of students, private investors, and institutional representatives. This blend gave the discussion a broad perspective: from generation-specific expectations to questions about sovereignty, privacy, and usefulness. The aim of the meeting was not to announce a launch date, but to clarify where the project stands and why the ECB and national central banks are investing so much effort into it.

Where the Digital Euro Project Stands Today

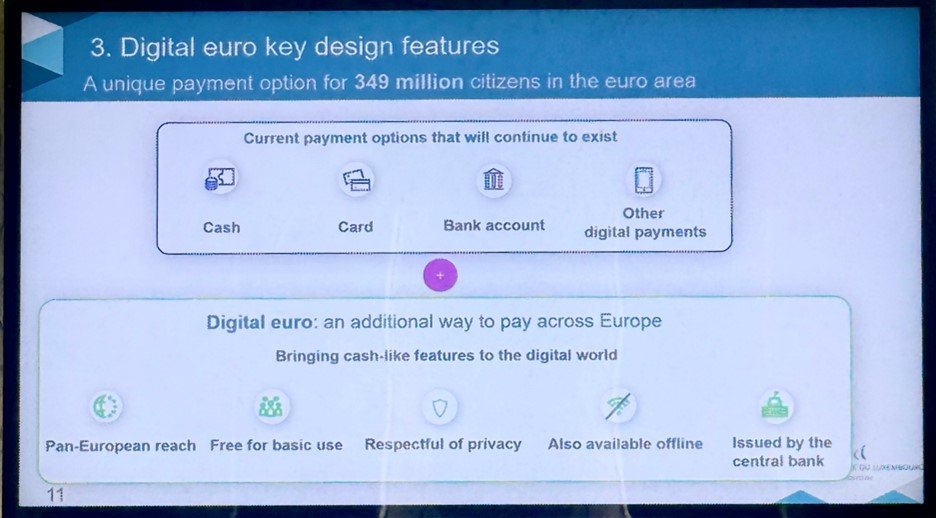

According to the speakers, the Digital Euro is envisioned as a complement to cash, not a replacement. This message is central, especially since many citizens fear the opposite. The ECB’s latest payments report indicates that cash use has already fallen from 67 percent to 43 percent of point-of-sale transactions in the euro area, a trend driven by the rapid rise of cards, mobile apps, and new fintechs.

Despite this evolution, Europe still depends heavily on non-EU payment schemes. They also mentioned that 13 out of 20 eurozone countries rely mainly on international networks such as Visa or Mastercard. This raises questions about resilience and strategic autonomy, especially in crisis situations. The Digital Euro is meant to be one additional layer of stability, built on European infrastructure.

The project is currently in the preparation phase. The ECB and national central banks are drafting the rulebook, defining technical standards, selecting potential intermediaries, and waiting for the European legislative text that will set the legal framework. Only after this step will any form of rollout be considered.

Why Europe Wants a Digital Euro

The rationale presented during the conference can be summarised in three points:

1)Maintaining sovereignty. With most digital payments flowing through non-European systems, the EU wants an option fully controlled within its borders.

2)Guaranteeing privacy. Central banks insist that offline Digital Euro payments will offer privacy levels close to cash, a feature that many private solutions cannot guarantee under current business models.

3)Ensuring resilience. The Digital Euro would act as a public anchor next to private payment providers, reducing the risk that market concentration could limit competition or access.

Real Reactions: How the Audience Responded

Discussions with Goldbridge members and INVESTAS participants showed that interest was high, but so was scepticism. Among younger attendees, many already rely on Revolut, PayPal, or cryptocurrencies. Their main question was whether the Digital Euro would offer anything truly superior to the tools they already use every day. Comments often pointed to convenience: “If it does not add value, why would people switch?”

The more senior members of INVESTAS also questioned its practical necessity. Several noted that payments within Europe already function smoothly, raising doubts about how quickly consumers would adopt another option.

Still, certain aspects were positively received. The continued protection of cash, the emphasis on privacy, and the inclusion of specific solutions for students were viewed as positive. The main uncertainty remains adoption: even with a robust public infrastructure, will Europeans feel the need for a new payment instrument?

Key Takeaways

• Cash remains part of the European payments landscape. The Digital Euro is intended to complement it, not replace it.

• The project is still in its legislative and technical definition phase. The rulebook and EU legal text are essential before any action.

• Core objectives include privacy, resilience, and reinforcing European payment sovereignty.

• Both young and senior participants questioned the added value for everyday use, highlighting adoption as a major open question.

Looking Ahead

The discussions at the BCL reflect a broader European debate. As the legislative work moves forward and the technical details fall into place, we will get a clearer picture of how the Digital Euro will fit into everyday life.

What is certain is that Luxembourg will stay closely involved in the discussion, given its importance role in Europe’s financial ecosystem.